- How to apply for Business Funding in South Africa

How to apply for Business Funding in South Africa

Teboho Nkwanyana is a successful business owner who makes a significant contribution to the economy. His business, the Salad Bar, doubled turnover from one year to the next. But when it came to getting a business loan, none of that was enough.

When Nkwanyana approached his bank for a business loan, the application process was difficult and drawn-out. “I applied for a business loan to my bank several times. Each time there was either no response or a decline with no reasons.”

Nkwanyana’s story reflects a struggle shared by many SMEs.

South African business owners say there’s been little improvement in access to SME finance, according to a 2018 study by the South African Banking Association. For many SMEs, a big part of the problem is finding the right information.

We’ve pulled together this compact guide to cover the most common questions around applying for a business loan with both banks and alternative lenders:

- How to select the best business loan

- Qualifying for a business loan

- How to apply for a business loan

- Paying back your business loan

If you’re in a rush, here’s a summary of the key steps in the business loan application process:

- Decide on what you need from a business loan

- Determine the minimum requirements to see if you qualify, e.g., collateral, credit score

- Gather all the relevant documents

- Study the repayment terms

- Apply

Selecting the best business loan

So, you need a business loan. If you’re battling to find the right one, you’re not alone.

In South Africa, SMEs can choose from 146 funders offering 328 different types of business loans according to this Finfind report. You might think all that choice makes getting a business loan easy. In truth, it’s even harder.

Many businesses are rejected because they’re applying for the wrong type of finance.

Figuring out your funding need is the first step in the business loan application process, explains Garth Rossiter, Lulalend’s Chief Risk Officer.

“You want to use your business loan for the right reasons: to grow your SME. Start by understanding your business’s financial needs.” Begin with the following questions, said Rossiter.

When do I need funding

Are there spikes and dips in business activity? Perhaps, your business is seasonal. Study the forces that influence when you’d need business finance.

For how long do you need the loan? Do you only need funds to cover late payments or service a new contract before you get paid.

Why do I need funding

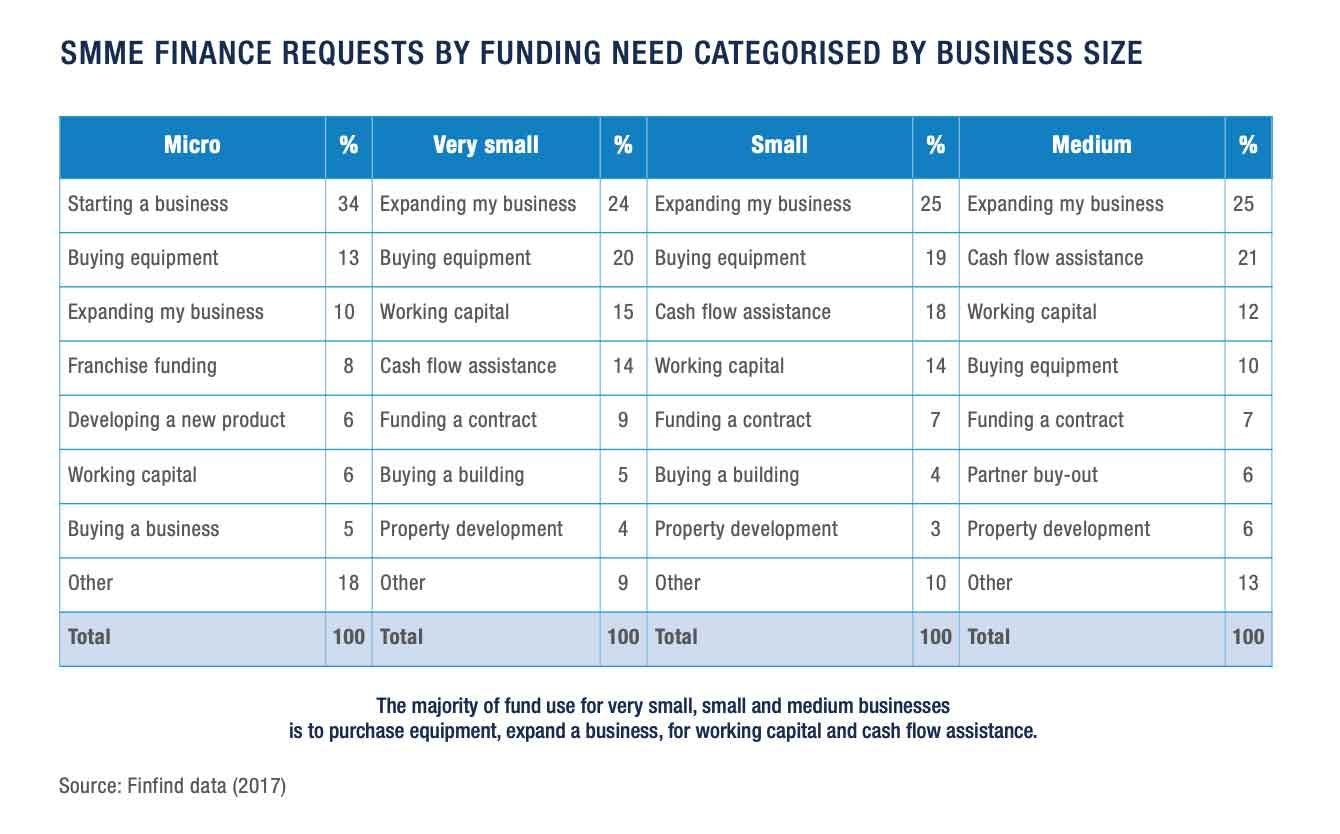

Let’s take a closer look at the common reasons SMEs seek business loans. Aside from startup costs, most requests are for equipment finance and business expansion, according to a Finfind study.

Now list the eligible business loan providers:

Take the insights you gain during the first two steps and start listing the financial institutions which offer the type of business loan you need.

Qualifying for a business loan

As you’ll see later in this guide, business loan requirements vary depending upon the lender. To speed up the process, speak to the lender before you apply.

We’ll go through the most common requirements here.

Credit score

What’s your credit score? Understanding your business credit worthiness is a great practice in general. But it’s especially important if you’re planning to take out a business loan.

Lenders will base their decisions, in part, on your credit rating.

Once you submit your business loan application, lenders will access data about your credit history from the credit bureaus. There are indicators that influence your credit rating, and these include:

- Your current levels of debt

- Your payment history

Lulalend’s Rossiter emphasises “It’s important to maintain a good repayment history on long-standing accounts”

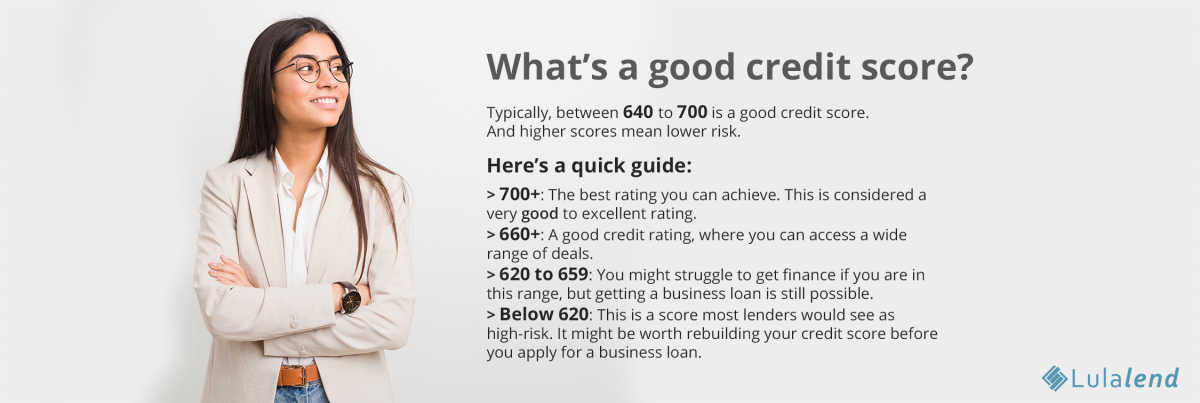

What’s a good credit score to get a business loan?

There’s a lot of focus on personal credit scores when it comes to business loans. Truth is, these personal credit scores are usually only one of several factors considered when lenders determine your business credit score. However, a poor personal credit score will work against you.

Typically, between 640 to 700 is a good personal credit score. A higher score means lower risk.

Here’s a quick guide to personal credit ratings (ranges will vary depending on credit bureaus):

- 700+: the best rating you can achieve. This is considered a very good to excellent rating.

- 660+: a good credit rating, where you can access a wide range of deals

- 620 to 659: you might struggle to get finance if you are in this range, but getting a business loan is still possible

- Below 620: this is a score most lenders would see as high-risk. It might be worth rebuilding your credit score before you apply for a business loan

If you’re applying for a business loan, your personal credit score may be considered along with several other assessment criteria. Lenders are rating your business. And your personal score is just a single data point they might take into account when they model your risk.

Collateral

Has your business loan been rejected because of a lack of physical collateral? A lack of collateral is among the most common problems facing SMEs on the hunt for a business loan.

Finfind provides an overview of the legal obligations that come with collateral for business loans: “You CANNOT sell that asset without the written consent of the lender. Once the loan has been repaid in full, the lender no longer has a claim to the asset and you are free to sell it if you wish.”

Examples of physical collateral include:

- Equipment

- Real estate

- Vehicles

- Stock

Because SMEs are perceived as a higher credit risk, banks typically demand valuable assets as collateral. Plus, the lender will often value your assets for far less than they’re actually worth. That’s because the funder will be saddled with the costs of selling the assets.

The problem with this approach is obvious, explains Rossiter: “Many SMEs don’t have access to physical collateral. But they have good cash flow.”

No collateral? You still have options. More and more funders are offering unsecured business loans or will waive the need for collateral if you have a purchase order. And most fintechs lenders don’t require collateral.

Time in business

Nearly every type of business loan provider cites time in business as a critical requirement.

For traditional lenders this typically excludes business owners who have only been operating for a few years. Fintech providers usually only require 1 year of trading.

Annual revenue

Most business loan providers will have set minimum revenue requirements. This differs from lender to lender, but again is often lower for Fintech lenders.

How to apply for a business loan

Once you’ve confirmed you meet the minimum requirements a lender has, it’s time to submit your application.

Financial documents:

You need to gather all the correct documents. And while this sounds like the easy part, it’s one of the biggest reasons business owners get declined.

We’ve listed below the documents you need for loans offered to SMEs from a selection of lenders:

Capitec:

- South African ID

- Three-months salary slips (only SMEs who get a salary from their business are eligible)

- Three months bank statement

FNB:

- 6 months bank statements

- Annual financial statements

- Year-to-date management accounts

- Cash flow statements

- Income statements

- Balance sheets

- Business plan

ABSA:

- South African ID

- Notice of incorporation

- Registration certificate

- Shareholder certificate

- 6 months bank statements (if you’re not an ABSA client)

- All directors to be present to sign application

Nedbank:

- One-year transactional history

- Pro forma invoice demonstrating intended use of funds, up to 70% of the advance value

Lulalend:

- Only three months bank statements or management accounts

Paying back your business loan

Before you submit your application, read the terms and conditions, advises Rossiter. And think about this question: for how long will you need the money?

If you might want to pay your loan quickly, prioritise funding that doesn’t come with early settlement charges.

“Ask about early settlement or prepayment costs. You need your funding to be as flexible as your business. Can you settle early? What if you only need the funding for a day or two?”

Many traditional lenders for instance will require three months written notice if you want to settle early. And you’ll still have to cover the interest due.

To apply or not?

It’s easy to see the business loan application process as an obstacle: a barrier between you and achieving your goals. But, it doesn’t need to be that way.

Start by gaining insight into your business. When and why do you need cash flow? Then thoroughly research the market for the type of loan and lenders that best meet your business’s needs. Take the time to understand the qualifying criteria, and clarify if you meet them.

Once you’ve completed these steps you’ll be in the best position to secure a business loan that propels your SME forward.

An application with Lulalend will take only minutes to complete and requires no paperwork. Find out more.

Plus: See when you need an accounting officer.